As S&P BSE SmallCap: Why Global Investors Are Eyeing Indian Stocks takes center stage, this opening passage beckons readers with engaging insights into the world of Indian stocks. It promises a deep dive into the reasons behind the growing interest of global investors in this market.

Overview of S&P BSE SmallCap Index

The S&P BSE SmallCap Index is a market capitalization-weighted index that represents the small-cap segment of the Indian stock market. It includes companies with relatively smaller market capitalization compared to large-cap and mid-cap stocks.

Criteria for Inclusion in S&P BSE SmallCap Index

To be included in the S&P BSE SmallCap Index, a stock must meet certain criteria such as market capitalization and liquidity. The stocks included in this index are typically of companies that are smaller in size and have the potential for growth.

- Market Capitalization: Stocks with market capitalization below a certain threshold are considered for inclusion in the SmallCap Index.

- Liquidity: Stocks should have a minimum level of trading activity to ensure that investors can buy and sell them easily.

- Eligibility: Companies must meet the listing and trading requirements set by the exchange to be considered for inclusion in the index.

Significance of Tracking Small-Cap Stocks through S&P BSE SmallCap Index

Tracking the performance of small-cap stocks through the S&P BSE SmallCap Index provides investors with insights into the performance of smaller companies in the Indian market. It allows investors to diversify their portfolios and potentially benefit from the growth prospects of small-cap companies.

- Diversification: Including small-cap stocks in a portfolio can help reduce overall risk and increase potential returns.

- Growth Potential: Small-cap companies often have room for growth and can provide significant returns to investors who are willing to take on higher risk.

- Market Trends: Monitoring the performance of small-cap stocks can help investors identify emerging trends and opportunities in the market.

Global Interest in Indian Stocks

Global investors are increasingly eyeing Indian stocks due to several key reasons. India's robust economic growth, political stability, demographic dividend, and ongoing structural reforms make it an attractive investment destination.

India's Economic Growth and Stability

India's consistent economic growth, driven by a large consumer base, expanding middle class, and increasing urbanization, offers significant opportunities for investors. The country's stable political environment and proactive monetary policies also contribute to its appeal.

Foreign Investment Attraction

- India's growing focus on ease of doing business, infrastructure development, and digital transformation initiatives have attracted foreign investors looking for long-term growth prospects.

- The introduction of initiatives like Make in India, Digital India, and Startup India has further enhanced India's investment climate, encouraging global investors to tap into the market.

- India's young and tech-savvy population, coupled with a thriving startup ecosystem and increasing internet penetration, offers a fertile ground for innovation and investment opportunities.

Recent Trends in Global Interest

- Foreign Institutional Investors (FIIs) have been increasing their exposure to Indian equities, reflecting confidence in the country's economic potential and growth trajectory.

- Strategic partnerships, joint ventures, and acquisitions involving Indian companies and global firms have been on the rise, showcasing the growing interest and collaboration between international and Indian businesses.

- The rise of India-focused exchange-traded funds (ETFs) and mutual funds in global markets indicates a rising appetite for Indian stocks among international investors seeking diversification and higher returns.

Factors Driving Foreign Investments

Foreign investments in Indian stocks are influenced by various factors that shape the attractiveness of the market. These factors play a crucial role in driving global investors towards Indian small-cap stocks.

Government Policies and Market Reforms

Government policies and market reforms in India have a significant impact on foreign investment decisions. Reforms aimed at improving ease of doing business, simplifying regulations, and enhancing transparency attract foreign investors. For example, initiatives like Make in India and Digital India have created opportunities for foreign capital inflow into the country.

Additionally, the government's focus on infrastructure development and economic growth enhances the overall investment climate.

Industry Potential and Growth Prospects

The potential for growth in various industries within the Indian market is another key driver of foreign investments. Industries such as technology, healthcare, and renewable energy offer promising growth prospects, attracting global investors seeking to capitalize on emerging opportunities. The vast consumer market in India also presents significant potential for companies looking to expand their presence and increase market share.

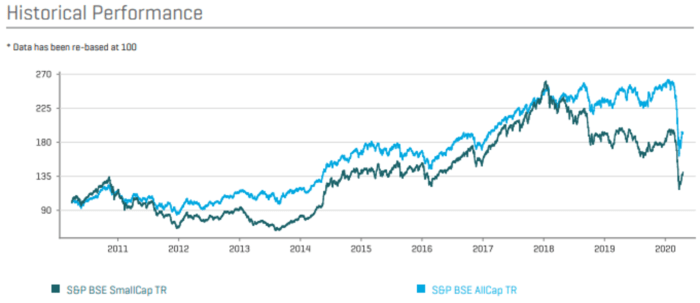

Comparative Performance with Global Small-Cap Indices

Comparing the performance of the S&P BSE SmallCap Index with other global small-cap indices provides insights into the attractiveness of Indian small-cap stocks. Despite market fluctuations, Indian small-cap stocks have shown resilience and outperformed many global counterparts. This outperformance, coupled with the growth potential of Indian industries, makes the market an appealing destination for foreign investors seeking high returns.

Regulatory Changes and Ease of Doing Business

Regulatory changes and improvements in the ease of doing business have a direct impact on foreign investment decisions in Indian markets. Streamlined regulatory processes, reduced bureaucratic hurdles, and increased transparency enhance investor confidence and encourage foreign capital inflow. The Indian government's efforts to create a more business-friendly environment through regulatory reforms and policy initiatives contribute to making the market more attractive for foreign investments.

Opportunities and Risks for Global Investors

India's small-cap segment presents a plethora of opportunities for global investors looking to diversify their portfolios and tap into the country's growing economy. However, alongside these opportunities, there are risks that investors need to be aware of and navigate effectively to make informed decisions.

Opportunities in Indian Small-Cap Stocks

- High Growth Potential: Indian small-cap stocks have the potential to deliver high returns due to their growth prospects in a developing economy like India.

- Untapped Market: Many small-cap companies in India operate in niche markets with limited competition, providing opportunities for growth and market expansion.

- Diversification: Investing in Indian small-cap stocks can help global investors diversify their portfolios and reduce overall risk exposure.

Risks and Mitigation Strategies

- Market Volatility: Small-cap stocks in India can be more volatile compared to large-cap stocks, leading to higher risk. Investors can mitigate this risk by diversifying their investments across sectors and companies.

- Liquidity Risk: Small-cap stocks may have lower liquidity, making it challenging to enter or exit positions quickly. Investors should conduct thorough research and invest in stocks with adequate trading volumes.

- Growth Uncertainty: The growth potential of small-cap stocks can be uncertain, as these companies may face challenges in scaling up operations. Investors should analyze the company's fundamentals and growth prospects before investing.

Closing Notes

In conclusion, the discussion around S&P BSE SmallCap and the interest of global investors in Indian stocks highlights the dynamic nature of the market and the potential it holds for investors worldwide.

FAQ Summary

What criteria determine a stock's inclusion in the S&P BSE SmallCap Index?

Stocks need to meet specific market capitalization and liquidity requirements to be included in the index.

What are some risks associated with investing in S&P BSE SmallCap stocks?

Risks include higher volatility and liquidity issues compared to large-cap stocks. Diversification can help mitigate these risks.

How do regulatory changes impact foreign investment decisions in Indian markets?

Regulatory changes can influence investor confidence and perception of market stability, affecting foreign investment inflows.