How to Start a Crypto IRA: Tax-Free Wealth Building sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a focus on tax-free wealth building through cryptocurrency investments.

As we delve into the world of Crypto IRAs, we uncover the nuances of this innovative investment strategy that promises both financial growth and tax advantages.

Introduction to Crypto IRAs

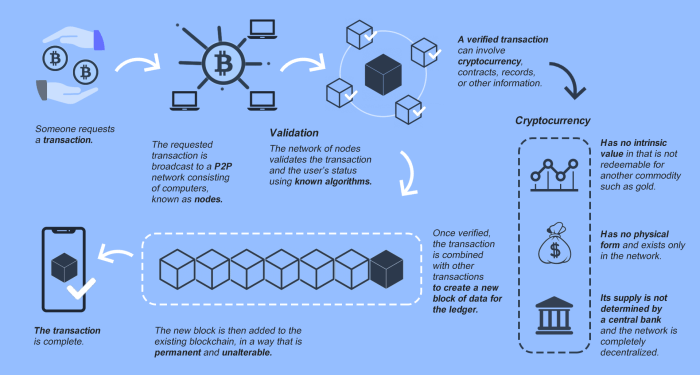

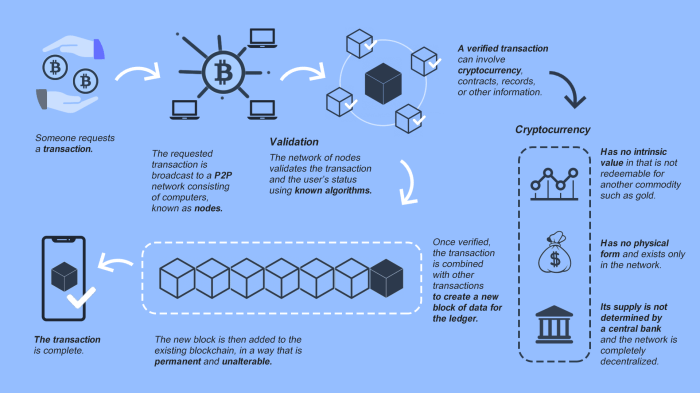

A Crypto IRA, or Individual Retirement Account, is a specialized retirement account that allows individuals to invest in cryptocurrencies such as Bitcoin, Ethereum, and other digital assets. Unlike traditional IRAs that primarily invest in stocks, bonds, and mutual funds, a Crypto IRA focuses on the emerging crypto market.

Benefits of Investing in a Crypto IRA

- Opportunity for high returns: The volatile nature of cryptocurrencies can lead to significant profits if the market performs well.

- Tax advantages: Investing in a Crypto IRA allows for tax-deferred growth and potential tax-free withdrawals in retirement.

- Diversification: Adding cryptocurrencies to your retirement portfolio can help diversify your investments and reduce overall risk.

- Potential for innovation: Investing in cryptocurrencies provides exposure to cutting-edge technology and innovations in the financial sector.

Potential Risks Associated with Crypto IRAs

- Volatility: Cryptocurrencies are known for their price fluctuations, which can lead to both significant gains and losses.

- Lack of regulation: The crypto market is not as regulated as traditional financial markets, increasing the risk of fraud and manipulation.

- Security concerns: Storing cryptocurrencies securely can be challenging, as they are vulnerable to hacking and theft.

- Liquidity risk: Some cryptocurrencies may have limited liquidity, making it difficult to buy or sell them at desired prices.

Eligibility and Regulations

To open a Crypto IRA, individuals must meet certain eligibility criteria and adhere to specific regulations and restrictions. Understanding these guidelines is crucial for successful wealth building through tax-free investments.

Eligibility Criteria

- Individuals must be under the age of 70 and a half to contribute to a Crypto IRA.

- Income limits may apply depending on the type of Crypto IRA chosen (traditional or Roth).

- Employment status and access to employer-sponsored retirement plans can impact eligibility.

Regulations and Restrictions

- Crypto IRAs are subject to the same rules and regulations as traditional IRAs, including contribution limits and required minimum distributions.

- Transactions within a Crypto IRA must comply with IRS guidelines to maintain tax-advantaged status.

- Any early withdrawals from a Crypto IRA may incur penalties and taxes.

Contribution Limits and Withdrawal Rules

- For 2021, the contribution limit for traditional and Roth Crypto IRAs is $6,000 ($7,000 for individuals aged 50 and older).

- Withdrawals from a traditional Crypto IRA before the age of 59 and a half may result in a 10% early withdrawal penalty.

- Roth Crypto IRAs allow penalty-free withdrawals of contributions at any time, but earnings may be subject to penalties if withdrawn early.

Setting Up a Crypto IRA

When it comes to setting up a Crypto IRA account, there are several important steps to consider. It's crucial to choose a reputable and secure provider to ensure the safety of your investments.

Choosing a Reputable Crypto IRA Provider

- Research different platforms and providers that offer Crypto IRAs. Look for companies with a strong track record and positive reviews from customers.

- Check if the provider is registered with the appropriate regulatory bodies and complies with all necessary regulations.

- Consider the fees associated with the account, including transaction fees, management fees, and any other charges that may apply.

- Look for providers that offer a wide range of investment options and have a user-friendly platform for managing your Crypto IRA.

- Ensure that the provider takes security measures seriously, such as using encryption technology to protect your personal information and assets.

Investment Strategies

Cryptocurrency IRAs offer a unique opportunity for tax-free wealth building through strategic investments. Diversifying your portfolio and effectively managing your investments are key to long-term growth and success.

Diversification for Long-Term Growth

- Allocate your funds across different cryptocurrencies to spread risk and maximize potential returns.

- Include a mix of established cryptocurrencies like Bitcoin and Ethereum, as well as promising altcoins with growth potential.

- Consider adding stablecoins to balance the volatility of other cryptocurrencies in your portfolio.

- Explore other investment options like cryptocurrency mining or staking to diversify your holdings.

Monitoring and Managing Investments

- Regularly track the performance of your investments to identify trends and make informed decisions.

- Stay updated on market news, regulatory changes, and technological developments that could impact your portfolio.

- Set clear investment goals and adjust your strategy as needed to align with your financial objectives.

- Consider working with a financial advisor specializing in cryptocurrency investments to receive expert guidance.

Tax Implications and Reporting

Cryptocurrency IRAs offer significant tax advantages that can contribute to tax-free wealth building. One of the key benefits is the ability to defer taxes on any gains made within the IRA until the funds are withdrawn. This means that investors can potentially grow their investments without having to pay taxes on the profits each year, allowing for more rapid wealth accumulation over time.

Tax Advantages of a Crypto IRA

- Deferral of taxes on capital gains: Unlike traditional investments where taxes are due each year on any gains, a Crypto IRA allows investors to defer taxes until funds are withdrawn.

- Tax-free growth: By keeping profits within the IRA, investors can benefit from compounding growth without incurring taxes along the way.

- Potential for tax-free withdrawals: Depending on the type of Crypto IRA, investors may be able to make tax-free withdrawals in retirement, providing a source of tax-free income.

Reporting Crypto IRA Transactions

- Form 1099: It is important to ensure that all transactions within the Crypto IRA are properly reported to the IRS. This may involve filing Form 1099 for certain transactions, such as distributions or rollovers.

- Consult a tax professional: Given the complex nature of cryptocurrency transactions and IRS regulations, it is advisable to seek the guidance of a tax professional to ensure compliance with reporting requirements.

Tax Implications to be Aware of

- Unrelated business income tax (UBIT): Holding certain types of investments, such as actively traded cryptocurrencies, within a Crypto IRA may trigger UBIT, potentially subjecting the IRA to additional taxes.

- Prohibited transactions: Engaging in prohibited transactions within a Crypto IRA, such as using the assets for personal benefit, can lead to severe tax penalties and disqualification of the IRA.

Final Summary

In conclusion, How to Start a Crypto IRA: Tax-Free Wealth Building opens the door to a world of possibilities for investors seeking to build wealth while minimizing tax implications. With careful planning and strategic investment decisions, the journey towards financial freedom through Crypto IRAs is within reach.

Q&A

What are the eligibility criteria for opening a Crypto IRA?

To open a Crypto IRA, individuals must meet specific income and contribution requirements, as well as follow IRS guidelines for retirement accounts.

What are the potential risks associated with Crypto IRAs?

Some risks include market volatility, regulatory changes, and security concerns related to cryptocurrency investments. It's essential to conduct thorough research and consider all factors before investing.

How can investors diversify their Crypto IRA portfolio for long-term growth?

Investors can diversify by investing in a variety of cryptocurrencies, spreading investments across different sectors, and adjusting their portfolio based on market trends.

What are the tax implications of holding cryptocurrencies in an IRA?

Investors should be aware of potential tax consequences related to capital gains, income tax, and reporting requirements when holding cryptocurrencies in an IRA. Consult with a tax professional for guidance.