Exploring the potential of Crypto for Retirement: Can Bitcoin Replace Your 401(k)? This introduction sets the stage for a detailed exploration of cryptocurrency as a retirement investment option, presenting key insights and considerations in a compelling manner.

The following paragraph will delve into the intricacies of using Bitcoin as a retirement investment, providing valuable information for readers interested in diversifying their portfolios.

Introduction to Crypto for Retirement

When planning for retirement, many people turn to traditional investment options such as a 401(k) plan. A 401(k) is a retirement savings account offered by employers, where employees can contribute a portion of their salary towards their retirement fund. These contributions are often invested in stocks, bonds, and mutual funds.

However, with the rise of cryptocurrency, some individuals are considering Bitcoin as an alternative investment for their retirement savings. Bitcoin, a digital currency that operates independently of a central bank, has gained popularity as a potential hedge against inflation and a store of value.

Using Bitcoin for Retirement Savings

- One of the main benefits of using Bitcoin for retirement savings is the potential for high returns. The price of Bitcoin has experienced significant growth over the years, making it an attractive investment option for those looking to build wealth for retirement.

- Another advantage of Bitcoin is its decentralized nature, meaning that it is not controlled by any government or financial institution. This can provide a level of financial independence and security for investors.

- However, it's important to note that investing in Bitcoin comes with its risks. The cryptocurrency market is highly volatile, and the price of Bitcoin can fluctuate dramatically in a short period of time. This volatility can lead to substantial losses if not managed properly.

- Additionally, the regulatory environment surrounding Bitcoin and other cryptocurrencies is still evolving, which can introduce uncertainty and potential challenges for investors.

Understanding Bitcoin and 401(k) Plans

Bitcoin is known for its high volatility compared to traditional investment options typically found in a 401(k) plan. While this volatility can lead to significant gains, it also poses a higher risk of losses compared to more stable assets like stocks and bonds.Cryptocurrency regulations play a crucial role in shaping retirement savings strategies.

The ever-evolving regulatory framework surrounding Bitcoin and other cryptocurrencies can impact how individuals choose to include these assets in their retirement portfolios. Factors such as tax implications, security regulations, and government oversight can all influence the decision-making process.

Historical Performance of Bitcoin vs Conventional Retirement Assets

When looking at the historical performance of Bitcoin compared to conventional retirement assets like stocks and bonds, it's essential to consider the significant price fluctuations that Bitcoin has experienced over the years. While Bitcoin has shown remarkable growth and has outperformed many traditional assets in recent years, it has also been subject to extreme price swings.Investors considering Bitcoin as part of their retirement strategy should weigh the potential for high returns against the inherent risks associated with this volatile asset.

Diversification, risk management, and staying informed about regulatory changes are key factors to consider when incorporating Bitcoin into a retirement portfolio.

Considerations for Investing in Bitcoin for Retirement

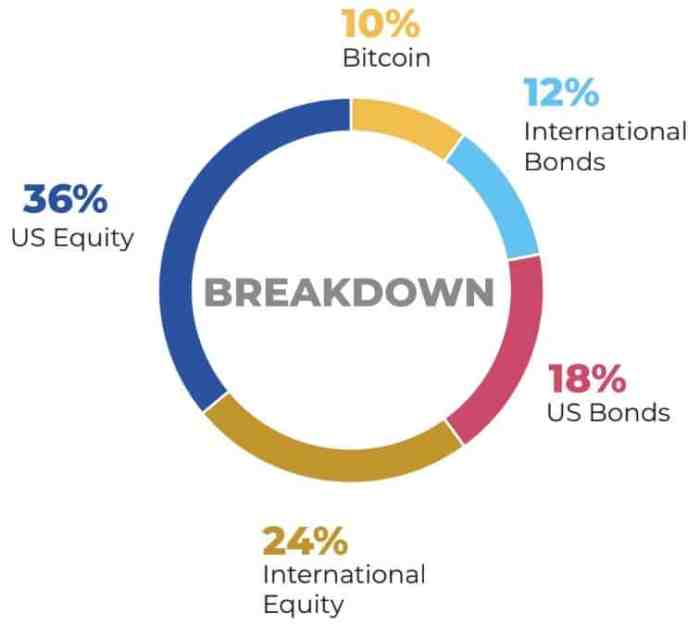

Investing in Bitcoin for retirement can be a strategic move for those looking to diversify their portfolios and potentially benefit from the growth of cryptocurrency. However, there are several important considerations to keep in mind when incorporating Bitcoin into your retirement planning.

Step-by-Step Guide to Incorporating Bitcoin into a Retirement Portfolio

- Educate Yourself: Understand how Bitcoin works, its volatility, and its long-term potential.

- Choose a Secure Platform: Select a reputable cryptocurrency exchange or wallet to buy and store your Bitcoin securely.

- Allocate Funds: Decide how much of your retirement portfolio you want to allocate to Bitcoin, considering your risk tolerance.

- Regular Monitoring: Keep track of your Bitcoin investments and adjust your portfolio as needed.

Tax Implications and Strategies when Using Cryptocurrency for Retirement Planning

- Consult a Tax Professional: Seek advice from a tax expert to understand how buying and selling Bitcoin may impact your tax liability.

- Long-Term Capital Gains: Holding Bitcoin for over a year may qualify for lower tax rates on any gains when sold.

- Consider Tax-Efficient Strategies: Utilize tax-advantaged accounts like IRAs or Roth IRAs for Bitcoin investments to potentially reduce tax burdens.

Analysis of Diversification Benefits of Adding Bitcoin to a Retirement Investment Mix

- Hedge Against Market Volatility: Bitcoin has shown to have a low correlation with traditional assets, providing potential diversification benefits in a retirement portfolio.

- Potential for Growth: The growth potential of Bitcoin may offer an opportunity for increased returns in a well-diversified retirement investment mix.

- Risk Management: Diversifying with Bitcoin can help spread risk across different asset classes, reducing the impact of market fluctuations on your retirement savings.

Risks and Challenges of Using Bitcoin for Retirement

When considering using Bitcoin for retirement planning, it is crucial to be aware of the risks and challenges that come with investing in cryptocurrency for long-term financial security.

Potential Security Risks Associated with Storing Bitcoin

Storing Bitcoin securely is essential to protect your retirement savings from potential cyber threats and hacking attempts. Unlike traditional financial institutions, cryptocurrency exchanges are not insured, making them vulnerable to security breaches.

- Use hardware wallets or cold storage solutions to safeguard your Bitcoin holdings offline.

- Implement strong security measures such as two-factor authentication and regular software updates to minimize the risk of unauthorized access.

- Stay informed about the latest security threats and best practices for securing your cryptocurrency assets.

Impact of Market Fluctuations on Retirement Savings

The volatile nature of the cryptocurrency market can pose a significant risk to your retirement savings. Sudden price fluctuations in Bitcoin can result in substantial gains or losses, impacting the value of your investment portfolio.

- Diversify your retirement portfolio to mitigate the effects of market volatility by including a mix of traditional assets along with Bitcoin.

- Regularly monitor market trends and set clear investment goals to make informed decisions about buying or selling Bitcoin.

- Consider working with a financial advisor who specializes in cryptocurrency investments to develop a risk management strategy tailored to your retirement objectives.

Liquidity Challenges of Converting Bitcoin to Cash

Converting Bitcoin to cash during retirement can present liquidity challenges, especially if the cryptocurrency market experiences limited trading volumes or regulatory restrictions.

- Plan ahead and establish a liquidation strategy for converting Bitcoin to cash when needed to cover living expenses or unexpected costs during retirement.

- Use reputable cryptocurrency exchanges with high liquidity and transparent fee structures to facilitate the conversion process efficiently.

- Be aware of potential tax implications and regulatory requirements associated with selling Bitcoin for cash to avoid compliance issues.

Wrap-Up

In conclusion, this discussion on Crypto for Retirement: Can Bitcoin Replace Your 401(k)? highlights the opportunities and challenges of incorporating cryptocurrency into retirement planning, offering a nuanced perspective on this evolving investment landscape.

Essential Questionnaire

What are the tax implications of using Bitcoin for retirement savings?

Answer: The tax treatment of cryptocurrency in retirement accounts can vary, so it's crucial to consult a tax professional for personalized advice.

How can one securely store Bitcoin for long-term retirement planning?

Answer: Utilizing hardware wallets or secure offline storage solutions can enhance the security of storing Bitcoin for retirement purposes.

Is it advisable to solely rely on Bitcoin for retirement savings?

Answer: Diversification is key in retirement planning, so while Bitcoin can be a part of your portfolio, it's generally not recommended to rely entirely on it for retirement savings.