How to Buy Gold with Cryptocurrency: Step-by-Step Guide sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. It delves into the world of purchasing gold using cryptocurrency, exploring the advantages, key factors to consider, and the process involved.

Introduction to Buying Gold with Cryptocurrency

Buying gold with cryptocurrency is a modern and convenient way to invest in precious metals using digital assets. This process involves exchanging your cryptocurrency, such as Bitcoin or Ethereum, for physical gold or gold-backed digital tokens.

Advantages of Using Cryptocurrency for Purchasing Gold

- Security: Cryptocurrency transactions are secure and encrypted, reducing the risk of fraud or theft associated with traditional payment methods.

- Speed: Transactions with cryptocurrency are processed quickly, allowing you to buy gold instantly without delays.

- Accessibility: Cryptocurrency can be traded globally, giving you access to gold markets around the world without geographical restrictions.

- Low Fees: Cryptocurrency transactions typically have lower fees compared to traditional banking systems, saving you money on transaction costs.

Key Factors to Consider Before Buying Gold with Cryptocurrency

- Research: Understand the current market conditions for both gold and cryptocurrency to make informed decisions.

- Reliability: Choose a reputable platform or exchange to ensure the security of your transactions and investments.

- Liquidity: Consider the liquidity of the gold-backed tokens or physical gold you are purchasing to easily trade or sell in the future.

- Regulations: Be aware of any legal regulations or tax implications related to buying gold with cryptocurrency in your country.

Choosing the Right Platform for Buying Gold

When it comes to buying gold with cryptocurrency, selecting the right platform is crucial. Different platforms offer varying features, security measures, and fees. Let's delve into the key factors to consider when choosing a platform.

Platform Comparison

- Exchanges: Cryptocurrency exchanges like Binance, Bitfinex, and Kraken allow users to buy gold with digital assets. These platforms offer a wide range of cryptocurrencies to choose from for purchasing gold.

- Specialized Platforms: There are platforms specifically designed for buying gold with cryptocurrency, such as Vaultoro and Goldmoney. These platforms focus solely on the exchange between gold and digital currencies, providing a more specialized service.

Security Measures

- Multi-Signature Wallets: Many platforms use multi-signature wallets to enhance security. This means that multiple private keys are required to authorize a transaction, reducing the risk of unauthorized access.

- Cold Storage: Some platforms store the majority of their users' funds offline in cold storage, adding an extra layer of protection against hacking attempts.

- Two-Factor Authentication: Implementing two-factor authentication (2FA) helps secure user accounts by requiring a second form of verification, such as a code sent to a mobile device.

Associated Fees

- Trading Fees: Platforms typically charge trading fees for buying and selling gold with cryptocurrency. These fees can vary based on the platform and the volume of the transaction.

- Withdrawal Fees: Some platforms may also impose withdrawal fees when transferring gold or cryptocurrency out of the platform. It's essential to consider these fees when choosing a platform.

- Storage Fees: Depending on the platform, there may be storage fees associated with holding gold in your account. Be sure to understand these costs before making a decision.

Setting Up a Wallet for Storing Cryptocurrency

When it comes to buying gold with cryptocurrency, one of the crucial steps is setting up a secure wallet to store your digital assets. A cryptocurrency wallet is essential for storing, sending, and receiving cryptocurrencies like Bitcoin or Ethereum.

The Importance of Choosing a Secure Wallet

Choosing a secure wallet is paramount to safeguarding your cryptocurrency investment. A secure wallet ensures that your digital assets are protected from hacking attempts and unauthorized access. It provides you with a private key that gives you control over your funds and allows you to make transactions securely.

- Hardware Wallets: Hardware wallets are physical devices that store your private keys offline, making them less vulnerable to cyber-attacks.

- Software Wallets: Software wallets are applications or programs that can be installed on your computer or mobile device. While convenient, they are more susceptible to online threats.

- Online Wallets: Online wallets are cloud-based and accessible from any device with an internet connection. They are convenient but pose a higher risk of hacking.

- Paper Wallets: Paper wallets involve printing your private keys on a piece of paper and storing it in a secure location. They are immune to cyber-attacks but can be easily lost or damaged.

It is essential to choose a wallet that offers a good balance between security and convenience based on your needs and preferences.

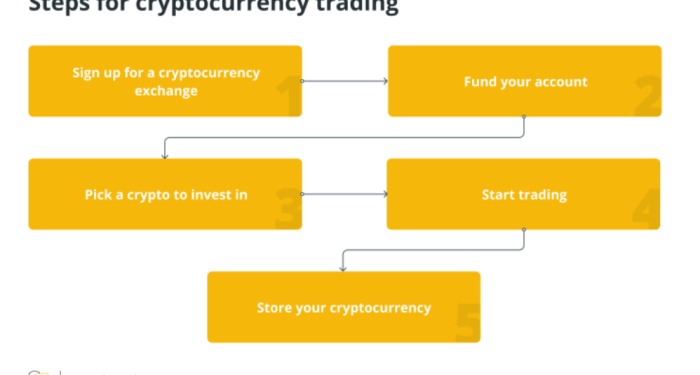

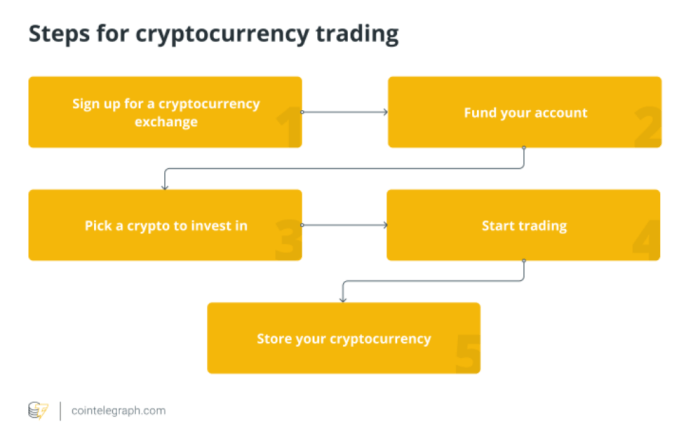

Purchasing Gold with Cryptocurrency

When it comes to buying gold with cryptocurrency, it's essential to choose a reliable platform that facilitates this transaction securely

Buying Gold with Cryptocurrency on XYZ Platform

One popular platform for buying gold with cryptocurrency is XYZ Platform. Here's how you can navigate the process:

- Create an account on XYZ Platform and complete the verification process.

- Deposit your desired cryptocurrency into your XYZ Platform wallet.

- Select the amount of gold you wish to purchase and proceed to checkout.

- Review the transaction details carefully before confirming the purchase.

- Once the transaction is complete, the gold will be securely stored in your XYZ Platform account.

Tips for Smooth Navigation

Here are some tips to ensure a smooth buying process:

- Do thorough research on the platform's reputation and security measures.

- Keep your cryptocurrency wallet secure to prevent unauthorized access.

- Double-check all transaction details before finalizing the purchase.

- Consider diversifying your investments to mitigate risks.

Potential Risks

While buying gold with cryptocurrency can offer diversification and flexibility, there are some risks to be aware of:

- Volatility: Cryptocurrency prices can fluctuate rapidly, impacting the value of your investment in gold.

- Security Concerns: Hacking and fraudulent activities pose a risk to your cryptocurrency and gold holdings.

- Lack of Regulation: The unregulated nature of cryptocurrencies can lead to potential scams and fraud in the market.

- Liquidity Issues: Selling your gold for cryptocurrency may not always be as straightforward as the initial purchase.

Storing and Securing Your Gold Assets

When it comes to storing and securing your gold assets obtained through cryptocurrency, it is essential to follow best practices to ensure the safety of your investments. Diversifying storage options for your gold assets can also provide added security and peace of mind.

Importance of Diversifying Storage Options

Diversifying storage options for your gold assets helps reduce the risk of losing all your investments in case of a security breach or unforeseen circumstances. By spreading your assets across multiple storage methods, you can mitigate potential risks and safeguard your investments.

- Consider storing a portion of your gold assets in a secure physical location, such as a safe deposit box or a home safe. This provides a tangible backup in case of technological failures.

- Utilize reputable third-party storage services that specialize in safeguarding precious metals. These facilities offer advanced security measures and insurance coverage for your gold assets.

- Explore decentralized storage options, such as hardware wallets or encrypted storage devices, to maintain full control over your assets and reduce reliance on centralized platforms.

Recommendations for Keeping Your Gold Investments Safe

Protecting your gold investments from potential threats requires careful planning and proactive measures to enhance security.

- Regularly update your security protocols and software to defend against evolving cyber threats and vulnerabilities.

- Enable two-factor authentication (2FA) for all your cryptocurrency accounts and storage solutions to add an extra layer of protection.

- Implement strong password practices by using complex, unique passwords for each account and regularly changing them to prevent unauthorized access.

- Avoid sharing sensitive information about your gold holdings or storage methods publicly to minimize the risk of targeted attacks or theft.

- Stay informed about the latest security trends and best practices in the cryptocurrency and precious metals industry to adapt your protection strategies accordingly.

Last Word

In conclusion, this guide has shed light on the intricate process of buying gold with cryptocurrency. From choosing the right platform to securely storing your assets, each step in this journey is crucial. By following the Artikeld steps and tips, you can navigate this unique investment opportunity with confidence and ease.

Answers to Common Questions

What are the advantages of using cryptocurrency to purchase gold?

Using cryptocurrency offers lower transaction fees, faster transactions, and increased privacy compared to traditional payment methods.

How do I set up a cryptocurrency wallet for storing my assets?

You can set up a wallet by choosing a reputable provider, following their instructions for creating an account, and securing your private keys.

What are the best practices for securely storing gold assets obtained through cryptocurrency?

It is recommended to use hardware wallets, cold storage, and multisignature wallets to enhance security and protect your investments.