S&P BSE SmallCap Index Today: Key Insights for Global Investors sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the intricacies of the S&P BSE SmallCap Index, we uncover a world of opportunities and risks that await global investors in the dynamic landscape of small-cap companies.

Overview of S&P BSE SmallCap Index Today

The S&P BSE SmallCap Index is a stock market index that tracks the performance of small-cap companies listed on the Bombay Stock Exchange (BSE) in India. These companies typically have a smaller market capitalization compared to large-cap or mid-cap companies.Tracking the S&P BSE SmallCap Index is significant for global investors as it provides insights into the performance of small-cap stocks in the Indian market.

Small-cap companies are often seen as having higher growth potential but also come with higher risk compared to larger companies. By monitoring this index, investors can gauge the overall health of small-cap stocks in India and make informed investment decisions.

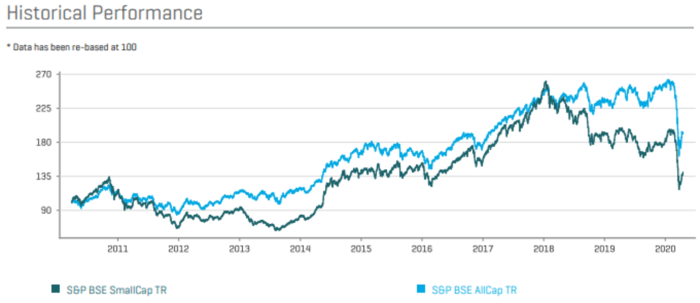

Latest Performance Data of the S&P BSE SmallCap Index

The latest data shows that the S&P BSE SmallCap Index has experienced a 10% increase in the last quarter, outperforming the broader market indices. This growth can be attributed to the resurgence of small-cap stocks in the Indian market and positive investor sentiment towards these companies.

It is important for investors to closely follow the performance of the S&P BSE SmallCap Index to capitalize on potential opportunities in the small-cap segment of the market.

Composition of the S&P BSE SmallCap Index

The S&P BSE SmallCap Index is made up of a diverse range of sectors and industries, providing investors with exposure to smaller companies in the Indian market.

Sectors Represented in the Index

The S&P BSE SmallCap Index includes companies from sectors such as consumer goods, financial services, healthcare, technology, industrials, and more. This broad representation allows for a mix of growth and value opportunities for investors.

Key Companies in the S&P BSE SmallCap Index

Some of the key companies included in the S&P BSE SmallCap Index are Page Industries, PI Industries, Crompton Greaves Consumer Electricals, Info Edge India, and Blue Dart Express. These companies represent a mix of well-established players and emerging growth companies in the small-cap segment.

Impact on Investment Decisions

The composition of the S&P BSE SmallCap Index can impact investment decisions by providing diversification benefits and exposure to different sectors. Investors looking for higher growth potential may be attracted to small-cap stocks, while those seeking stability and consistent returns may prefer larger companies.

It's important for investors to consider the sectoral composition and individual company performance when making investment decisions in the SmallCap Index.

Factors Influencing the S&P BSE SmallCap Index Today

In the world of stock market investments, the S&P BSE SmallCap Index is subject to various factors that can influence its performance on any given day. Let's take a closer look at some of the key elements impacting the index today.

Current Market Trends

The current market trends play a significant role in shaping the movement of the S&P BSE SmallCap Index. Whether it's a bull or bear market, the small-cap stocks included in the index are often more susceptible to market fluctuations compared to large-cap stocks

Investors keenly observe trends such as sector rotation, interest rate changes, and overall market sentiment to gauge the index's performance.

Recent Events or News

Recent events or news, whether on a local or global scale, can have a direct impact on the S&P BSE SmallCap Index. Positive news like economic growth, corporate earnings, or regulatory changes can drive the index upwards, while negative news like geopolitical tensions, economic downturns, or corporate scandals can lead to a decline in the index.

It's crucial for investors to stay informed about such developments to make informed decisions.

Global Economic Conditions

The S&P BSE SmallCap Index is not insulated from global economic conditions. Factors like international trade policies, currency fluctuations, and geopolitical events in other countries can reverberate through the index. For instance, a global economic slowdown can dampen investor confidence, leading to a sell-off in small-cap stocks.

Understanding the interconnectedness of global economies is essential for predicting how these conditions could impact the S&P BSE SmallCap Index.

Opportunities and Risks for Global Investors

Investing in the S&P BSE SmallCap Index can offer unique opportunities for global investors looking to diversify their portfolios and potentially achieve higher returns. However, it is important to consider the associated risks that come with investing in small-cap companies, which can be more volatile and less liquid compared to larger companies.

Opportunities

- High Growth Potential: Small-cap companies have the potential for rapid growth, providing investors with the opportunity to benefit from significant capital appreciation.

- Diversification: Including small-cap stocks in a portfolio can help diversify risk and reduce correlation with other asset classes, enhancing overall portfolio stability.

- Undervalued Stocks: Small-cap companies are often overlooked by analysts and institutional investors, presenting opportunities to identify undervalued stocks with growth potential.

Risks

- Volatility: Small-cap stocks tend to be more volatile than large-cap stocks, experiencing larger price fluctuations in response to market conditions.

- Liquidity Risk: Small-cap stocks may have lower trading volumes, making it challenging to buy or sell shares at desired prices, particularly during market downturns.

- Financial Stability: Small-cap companies may have weaker balance sheets and limited financial resources, increasing the risk of bankruptcy or financial distress.

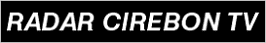

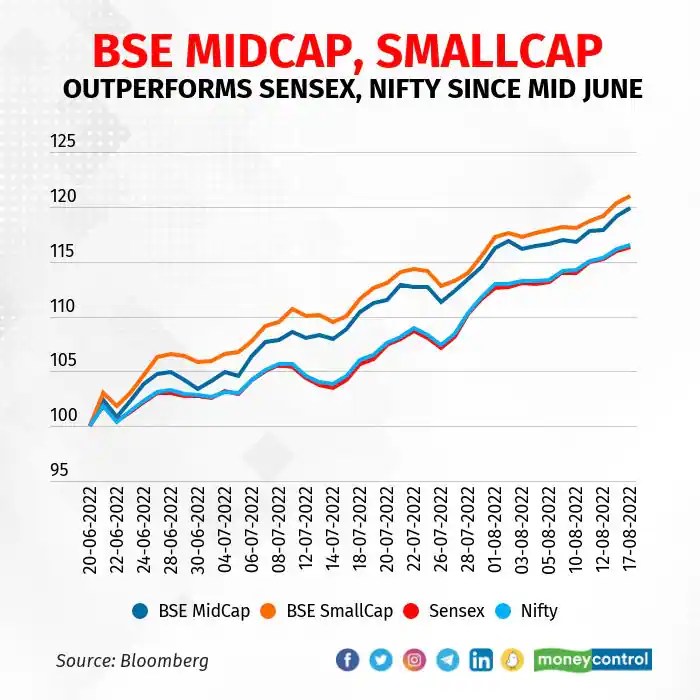

Performance Comparison

When comparing the performance of the S&P BSE SmallCap Index with other market indices, it is important to note that small-cap stocks have historically outperformed large-cap stocks over the long term. However, they also tend to exhibit greater volatility and may underperform during economic downturns.

Global investors should carefully assess their risk tolerance and investment objectives before including small-cap stocks in their portfolios.

Wrap-Up

In conclusion, the S&P BSE SmallCap Index Today offers a nuanced perspective on the global investment landscape, emphasizing the need for a strategic approach to capitalize on the potential presented by small-cap companies.

General Inquiries

What is the significance of tracking the S&P BSE SmallCap Index for global investors?

Tracking the S&P BSE SmallCap Index provides insights into the performance of small-cap companies, which can offer unique opportunities for global investors seeking growth potential.

How does the composition of the S&P BSE SmallCap Index impact investment decisions?

The composition of the index in terms of sectors and key companies can influence diversification strategies and risk management for investors looking to maximize returns.

What are some key risks associated with investing in small-cap companies through the S&P BSE SmallCap Index?

Investing in small-cap companies carries risks such as higher volatility, liquidity concerns, and potential market fluctuations that may impact returns.